When it comes to responsible investment, there is especially one term taking the stage, namely environmental, social, governance – short ESG. (Hong 2019)

According to the United Nations-supported organization Principles for Responsible Investment, sustainable financial systems reward long-term investments and benefit the society and the environment as a whole (Principles for Responsible Investment 2019). Successful investment depends on a prosperous economy, which in turn depends on a healthy society which furthermore requires a resilient and resourceful planet.

Ultimately, a better inclusion of ESG criteria into investment decisions contributes to more predictable and prosperous markets – a condition, which should be in the interest of all market actors. (UNEPFI 2005, pp. 3–4) But what are the main drivers of ESG?

1. ESG turning into „big business“

Not only is the integration of ESG aspects into investment decisions gaining ground. ESG is now increasingly considered as “quite literally, big business” (Kell 2018) and “going mainstream” (Whitley 2018a). Investors recognize that ESG information is essential to better understand corporate strategy, management and purpose. In 2019, 36 percent of institutional investors considered ESG to be a vital question. This number has more than doubled since 2016. (Hong 2019)

ESG is no longer a niche strategy. It helps businesses to reduce risks and achieve sustainable financial gains (Groom et al. 2019). There is increasing evidence that investors taking ESG into account deliver on improved investment performance (KPMG 2019).

BlackRock turning towards responsible investment

One of the most outstanding recent examples might be the “2020 letter to CEOs” written by Larry Fink. Fink is the CEO of the world’s largest investment management company BlackRock (McFarlane 2019). His letter has been referred to as a “wake-up call to all brands” (Mainwaring 2020). Herein, Fink states:

“Climate risk is investment risk […] Awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance. […] All investors, along with regulators, insurers, and the public, need a clearer picture of how companies are managing sustainability-related questions”. (Fink 2020)

Awareness about the impacts of climate change is growing. Priorities are shifting. And BlackRock, generally not known for its sustainable investments, is preparing for these changes along with numerous other investors and businesses (Mainwaring 2020).

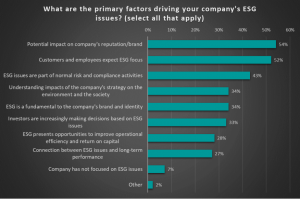

2. Business reputation

According to KPMG’s study ESG, risk, and return, in which nearly 900 board members and business leaders were polled in 2018, the main drivers of ESG in businesses are not just the investors. The most important drivers of ESG issues are the firms’ reputation (54 percent) and the firms’ stakeholders (52 percent), such as customers and employees who increasingly expect brands to make business sustainable. (KPMG International Cooperative 2018). The following figure based on KPMG International Cooperative (2018) shows the most important ESG drivers according to the KPMG study.

Every market actor will essentially come face to face with the impacts of environmental, social and governance risks. In a nutshell, businesses can no longer rely on long-term profits without embracing purpose and incorporating the needs of their most important stakeholders into business strategy. ESG ratings can support businesses in doing just that. They can help businesses in identifying trends, highlighting problems, monitoring progress and continuously adapting their business models in an ever-changing and fast-paced world. The continuous development and critical reflection of ESG-ratings is therefore a crucial undertaking which is likely to gain importance and influence an increasing number of people in their business, public and private life.

3. Millennials and Gen Z are changing the course

The results reveal that businesses are foremost concerned about their public image. Nowadays, a non-sustainable reputation can be fatal. Numerous papers and studies suggest that especially younger generations, such as Millennials (born between 1981 and 1996) and Generation Z (born between 1997 and 2012) show growing concerns about environmental and social challenges. (Deloitte 2019)

The Deloitte Global Millennial Survey 2019 surveying more than 13,000 Millennials in 42 countries, shows that the Millennials’ expectations on the role of businesses is changing: Businesses should, next to generating profits (28 percent), enhance the livelihood of their employees (33 percent), improve society (32 percent), improve their employees’ skills (27 percent) and protect the environment (27 percent). (Deloitte 2019, pp. 10–11) As Millennials and Generation Z currently make up 38 percent of the workforce and will make up about 58 percent of the workforce in ten years (Gilchrist 2019), businesses should be aware of the younger generation’s changing expectations.

Summary

According to McKinsey, ESG-oriented investments have experienced a “meteoric rise”, with global sustainable investments being higher than 30 trillion US-dollars as of 2019 (Henisz et al. 2019). This indicates a rise of 68 percent in comparison to 2014 and a tenfold rise since 2004. This acceleration can be linked to an increased social, governmental, and consumer attention on the impact of corporations. Furthermore, investors and executives increasingly realize that a strong ESG performance can secure a corporation‘s long-term success. (Henisz et al. 2019) These developments show that ESG is a trend that is likely to gain importance in the coming years. Stakeholders, such as employees, customers and investors will increasingly demand transparent ESG insights from businesses. Companies are therefore advised to be well-informed about their current ESG performance and deficits, and to strive towards continuously improving their ESG performance to ensure long-term competitiveness.

Sources:

Deloitte (2019): The Deloitte Global Millennial Survey 2019. Optimism, trust reach troubling low levels. Available online at https://www2.deloitte.com/global/en/pages/aboutdeloitte/articles/millennialsurvey.html, checked on 9/9/2019.

Gilchrist, Karen (2019): How millennials and Gen Z are reshaping the future of the workforce. CNBC. Available online at https://www.cnbc.com/2019/03/05/how-millennials-and-gen-z-are-reshapingthe-future-of-the-workforce.html, updated on 5/3/2019, checked on 3/11/2019.

Groom, B.; Orton-Jones, C.; Vella, H.; Gordon, J.; McClelland, J.; Gagan, O. (2019): Future of Infrastructure. Available online at https://www.raconteur.net/future-infrastructure-2019, checked on 6/9/2019

Henisz, W.; Koller, T.; Nuttall, R. (2019): Five ways that ESG creates value. McKinsey & Company. Available online at https://www.mckinsey.com/business-functions/strategy-and-corporatefinance/our-insights/five-ways-that-esg-creates-value?cid=other-eml-nsl-mipmck&hlkid=938444b141be4d6c818e903b8b2d7211&hctky=11172427&hdpid=bf3ea65f-cecc-4a66- b4ad-0a4a6f811d5a, updated on 1/11/2019, checked on 9/12/2019.

Hong, S. (2019): What’s next forESG and investment decisions? World Bank Blogs. Available online at https://blogs.worldbank.org/ppps/whats-next-esg-and-investment-decisions, updated on 07/31/2019, checked on 2/9/2019

Kell, Georg (2018): The Remarkable Rise OfESG. Forbes. Available online at https://www.forbes.com/sites/georgkell/2018/07/11/the-remarkable-rise-of-esg/#179d8abb1695, checked on 5/9/2019

KPMG (2019): The Rise of Responsible Investment. Four recommendations institutional investors and companies should consider when building ESGpolicies. KPMG. Available online at https://home.kpmg/xx/en/home/insights/2019/03/the-rise-of-responsible-investment-fs.html, checked on 2/9/2019.

McFarlane, Greg (2019): How BlackRock Makes Money. Investopedia. Available online at https://www.investopedia.com/articles/markets/012616/how-blackrock-makes-money.asp, checked on 1/2/2020.

Principles for Responsible Investment (2019): A Blueprint for Responsible Investment. Available online at https://www.unpri.org/pri/a-blueprint-for-responsible-investment, checked on 5/9/2019

UNEPFI (2005): Who Cares Wins. Available online at https://www.unepfi.org/fileadmin/events/2004/stocks/who_cares_wins_global_compact_2004.pdf, checked on 5/9/2019

Whitley, Jared (2018a): The Shortcomings of Sustainability Rating Agencies. Washington Examiner. Available online at https://www.investmentnews.com/article/20180210/FREE/180219999/is-esginvesting-going-mainstream, updated on 2/3/2018, checked on 3/11/2019