Climate-oriented adaptation is becoming increasingly important for the financial sector. At the same time, it poses challenges for most sectors. For example, there is no single agreed decarbonisation pathway, the methodologies for tracking alignment are unclear, and this is further compounded by the poor quality of the underlying data. In addition, pioneering financial institutions face potential disadvantages (loss of customers and investment opportunities) if they decide to move faster than their competitors.

Finally, the fact that the number of companies that are „climate friendly“ is not large enough to allow investors to adapt on the basis of divestment and capital reallocation also weighs heavily. Therein lies the key role of institutions to mobilise their clients and customers towards a zero-carbon transition as well as compliance with climate commitments.

This blog post gives a brief overview of the challenges financial institutions (banks, asset managers, asset owners) face on their path to climate adaptation and an approach to solving them.

The impacts of climate change are becoming increasingly clear, while at the same time the predictions of the consequences of climate change also promise a bleak future, and thus the demands to achieve climate goals from citizens to governments and private actors (companies, financial institutions) are becoming louder. [1]

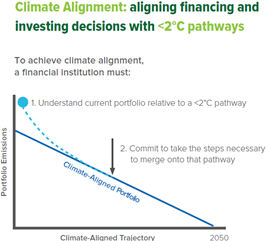

Figure 1: Climate Alignment

In addition to other sectors, the financial sector plays a key role in achieving climate protection goals. This is made clear, among other things, by Article 2.1c of the Paris Agreement, which calls for all financial flows to be brought into line with climate targets in a binding international framework. [2]

While environmental risk management, sustainable finance targets, the ban on coal financing and the disclosure of climate-related data were originally the focus of the financial sector, the emphasis is now shifting to the holistic concept of „climate alignment“.

To achieve climate alignment, a financial institution must (1) understand the climate impacts of its current portfolio and investment strategy in relation to an emissions pathway consistent with a <2°C future, and (2) commit to taking the necessary steps to transition to that pathway (figure 1).

The fact that financial institutions representing 17.2 trillion US dollars have committed to aligning their portfolios with the temperature targets of the Paris Agreement by the end of 2019 shows that the issue is highly topical for the financial sector.

Climate-oriented financing poses common challenges for the various financial institutions – from banks to asset owners. The five critical challenges are the diversity of decarbonisation pathways, different methodologies and insufficient data, as well as competitive disadvantages and the need to actively create solutions in the real economy. (figure 2).

Figure 2: Five barriers on the journey to climate alignment

Multiple Decarbonization Pathways to choose

The first step towards climate adaptation is to identify decarbonisation pathways to a <2°C future. Financial institutions need to develop an understanding of the different pathways for real economy portfolio segments (oil, gas, utilities, shipping) in order to promote the climate impact of the portfolio. An infinite number of pathways exist to well below 2°C. The Intergovernmental Panel on Climate Change’s (IPCC) last described ninety 1.5°C pathways. However, due to variation in modelling (technology costs, deployment rates, population and energy demand growth), these can vary significantly and the lack of a standard adaptation pathway can lead to various trade-offs across sectors.

Navigating Varying Methodologies

After choosing a climate-friendly pathway, a financial institution must agree on a methodology with which it will measure its progress towards this pathway. Again, various tools and methodologies exist, but two approaches in particular have gained acceptance among financial institutions.

Financial institutions primarily choose between funded emissions approaches that quantify the carbon footprint of a portfolio of investments. The Partnership for Climate Accounting Financials (PCAF) is considered a pioneer in the development of standardised methods for calculating financed emissions. PCAF’s goal is to create a simple, accessible framework. (More information).

Or they choose forward-looking approaches that use emissions scenarios, technology pathways and carbon budgets to support financial decision-making. The Paris Agreement Capital Transition Assessment (PACTA), developed by the 2 Degrees Investing Initiative (2dii), is a methodology that looks at technological changes required in key emitting sectors.

Lack of Data

Even after the choice of methodology, the financial institution faces the challenge of accessing high quality, decision-relevant data. Granular emissions data is often of poor quality or unavailable for many sectors and asset classes, making it difficult for them to obtain comparable, decision-relevant results.

Progress in disclosing corporate climate data is being made by voluntary initiatives such as CDP and TCFD. However, not all industries and regions report their greenhouse gas emissions.

Competitive Disadvantages

A single financial institution cannot single-handedly mobilise the climate adaptation pathway for the entire global economy. In doing so, financial institutions that choose climate adaptation risk losing their customers and investment opportunities to competitors. For example, a bank that aligns loans with climate adaptation, for example by requiring disclosure of emissions data and setting emissions targets, risks losing customers to another bank.

In order for so-called first-mover institutions not to be penalised for their climate adaptation efforts and for markets to move in this direction, collective action initiatives by a large number of financial institutions are needed.

Actively Influencing the Real Economy

The biggest hurdle in front of financial institutions is to achieve <2°C adaptation while investing in a 4°C world. The number of green asset classes (about 0.5 per cent) and the growth of sustainable investments is a small proportion of the total financial sector.

To actually achieve the climate targets, the financial sector needs to use the tools at their disposal (shareholder engagement, client relationships, innovative financial products) to effect change in the real economy.

Sectoral Approach to Climate Alignment

Breaking down these barriers across the global economy is a more inefficient and less pragmatic pathway towards climate adaptation. Sectors such as power generation, steel production, aviation or shipping each have their own political economies, data gaps and technological and business model pathways to decarbonisation. Financial institutions should therefore apply a sectoral approach to overcome these barriers. The sectoral approach helps them to break down the challenges into more manageable parts and put the problem solving at the relevant level.

Overcoming the barriers through a sectoral approach is only the beginning of a broader effort that financial institutions need to address in order to implement climate action across the portfolio. We look forward to supporting you with our more than 20 years of sustainability expertise and our customized services regarding circular economy business models! Contact us for more information at or +49.8192.99733-20.

References

Business Insider: https://www.businessinsider.de/politik/deutschland/neue-klimaziele-der-bundesregierung-so-viel-co2-sollen-industrie-energiesektor-und-co-kuenftig-einsparen/

UNFCC – Paris Agreement: https://unfccc.int/sites/default/files/english_paris_agreement.pdf

Partnership for Climate Accounting Financials (PCAF): https://www.carbonaccountingfinancials.com/about

Paris Agreement Capital Transition Assessment (PACTA):

IPCC, “Special report: Global warming of 1.5°C,” 2018.

[1]https://www.businessinsider.de/politik/deutschland/neue-klimaziele-der-bundesregierung-so-viel-co2-sollen-industrie-energiesektor-und-co-kuenftig-einsparen/

[2] https://unfccc.int/sites/default/files/english_paris_agreement.pdf