The acronym ESG is an English abbreviation which stands for ‘Environment’, ‘Social’ and ‘Governance’.

What are ESG criteria?

ESG criteria help investors to find out how sustainable a company behaves in order to be able to make more targeted investment decisions (e. g. to do risk assessments well). The ESG criteria are used by investors for the indicator-based measurement of sustainability aspects (including effects in sustainability-relevant areas) of a company. It focuses on environmental and social measures as well as corporate governance.

Subsuming, ESG criteria are the link between the sustainability activities on the company side and the investment decisions at the side of the investors. If an enterprise has already implemented a comprehensive CSR strategy to pursue specific sustainability goals, the chance of an external positive evaluation according to ESG criteria is more than supposable.

Content of the ESG criteria

Common examples of the environment are the level of energy use, the share of renewable energy sources, the climate change strategy, emissions, etc. Social aspects include for example respect for human rights, prohibition of child and forced labour, equality and diversity, workplace design, development, etc. The governance criterion aims to determine the extent to which sustainability is structurally implemented in the company. These include primarily system-specific aspects, which means the way in which sustainability management is integrated (e. g. holistic or functional), which anti-corruption measures have been implemented, are there environmental & quality management systems and so on.

In addition, the content orientation of the ESG criteria depends on the sector and the enterprise. Just as a company should identify its industry and company specific sustainability issues, ESG criteria also are following this principle.

Why are ESG criteria relevant?

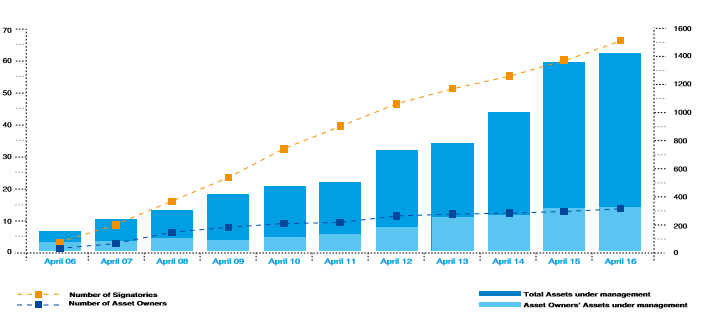

The consideration of sustainability-relevant aspects in investment decisions has become increasingly importance for investors in recent years (see Fig. 1). Investors pay more attention to the sustainability performance of relevant companies. This will improve the risk assessment of their investment and may increase the performance of the investment pool. Moreover, it’s obvious that sustainability and economic success go hand in hand. The consideration of ecological and social aspects doesn’t mean a reduced rate of return for investors. The past also shows that the shares of the enterprise value have changed. According to current opinions, 80% of this amount is already accounted for non-financial capital (e. g. know-how, sustainability, employee satisfaction, etc.), while the remaining 20% are covered by the financial indicators. This is a key criterion for investors to pay attention to sustainability-related services and to assess these according to ESG criteria.

For companies, it is essential to consider not only economic aspects but also ecological and social criteria within its business operations and to implement suitable structures. Thus, the company increases its potential in the areas of sustainability and is much more attractive for investors. The trend that investors will increasingly include ESG criteria in their decisions will continue to intensify in the future.

Which institutions and initiatives provide assistance regarding to ESG criteria?

The rating agencies have a high priority in the ESG context. These evaluate companies according to ESG criteria. The evaluation process is highly individual and different from rating company to rating company, because each agency has its own set of criteria (there is no standardization of ESG criteria, which makes comparisons difficult). Nevertheless, the rating agencies create insight and generate increased transparency regarding to the rated companies. This allows investors a more targeted estimation of their investment strategy.

Beside that is also the UN PRI (United Nations Principles for Responsible Investment). UN PRI is an initiative supported by the United Nations and has defined six principles for sustainable / responsible investment. The initiative has been signed by more than 1,800 investors so far (as at December 2017). The principles make it easier for investors to make sustainable investment decisions based on a clearly structured guideline and to make an adequate contribution to a long-term-oriented financial world.

Fig. 1 shows the development of the ‘Signatories’ (investor signatures) and the managed total assets of the UN PRI from the year 2006 to 2016. According to Fig. 1, the signatories have risen within ten years to almost 1,500, while the assets until April 2016 on nearly 60 trillion US dollars grew. This underlines the trend, described above, visually.

Fig. 1: Development of UN PRI signatures and total assets under management from April 2006 to April 2016 (Source: Annual Report UN PRI 2016, accessed on 12 December 2017)

Also in relation to a sustainability rating, the relevance of implementing a sustainability management is evident. By introducing sustainable measures ahead of time, the company is increasing the chance of a good rating. Unlikely to conventional evaluations, sustainable ratings are executed on the base of a customer request or as result of an investor inquire. If a company already shows various efforts in the field of sustainability and makes them transparent (e. g. in the form of a sustainability report), then it has extremely good chances for a positive evaluation. This, in turn, increases the possibility that investors becoming aware of it, who makes then investments for targeted projects. In addition, this form of evaluation is a good opportunity for companies to uncover opportunities and risk potential and to get to know their own strengths and weaknesses in the areas of sustainability.

In this context, credit institutes also play an important role. These act as lenders and pay more attention to ESG criteria as well. Regarding to conventional credit institutes such behaviour may is caused by trend-related reasons (recognition of the development and related potentials) as well as by risk assessment reasons. However, there are also numerous credit institutes whose business models are based on sustainable investments and responsible lending (e. g. GLS Bank, ‘Umweltbank’, ‘Ethikbank’, Triodos Bank, etc.). ESG criteria are a key factor in their daily business.

The DFGE advises your company to orient itself to relevant sustainability frameworks (e. g. UNGC or GRI) and to set up a comprehensive sustainability management. Thus, you are prepared for sustainability assessments (also in view of ESG criteria) and increase the chance of being identified by investors and credit institutes who are committed to sustainability. In addition, the DFGE actively supports you in the sustainability ratings CDP, EcoVadis and DJSI with various packages (depending on your needs). Contact us for your Sustainability Intelligence at or + 49.8192.99733-20.