The TCFD framework (Task Force on Climate-related Finance Disclosures) is becoming increasingly popular. Chairman Mike Bloomberg and Mark Carney (chief of the Financial Stability Board) announced the growing importance of such framework and the increasing support from the economy at the ‘One Planet Summit’ (additional World Climate Summit on the 2nd anniversary of the Paris Climate Change Conference in Île Seguin, France).

What is the TCFD?

TCFD provides recommendations for the disclosure and reporting of climate-related risks and opportunities for companies which are affected by climate-related financial risks. In particular, stakeholders of these companies (e.g. investors, banks, insurance companies, …) are asking for such information because a misallocation of invested funds (due to unrecognized climatic factors) poses a great risk for the financial markets. Companies which consider such guidelines for disclosure can better assess such impacts and can have an impact on the transformation towards a sustainable and low-carbon economy.

Structure of the TCFD

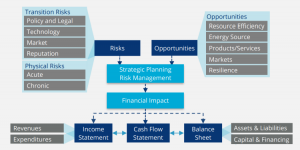

The TCFD classifies two types of risks:

- Physical risks (caused by climate change, e. g. sea level rise, extreme weather events, …)

- Transition risks refering to the transition to a low-carbon economy (e. g. stricter regulations on climate protection)

The structure:

Fig. 1: Structure of the TCFD framework (source: paper ‘CDP Technical Note on the TCFD’, p. 8)

Current developments

- Over 240 companies (as of Feb. 2018) are currently participating in the TCFD (market capitalization of approximately $ 6.3 trillion)

- Included: various (large) banks and insurance companies which are responsible for assets and investments of $ 81.7 trillion

- Through TCFD recommendations, climate-related opportunities and risks can be measured in a standardized manner and reported transparently, because most of the organizations don’t have a suitable database for that so far

Fig. 2: Influence of climate-related risks and opportunities on financial aspects (source: paper ‘CDP Technical Note on the TCFD’, p. 6)

Relations to CDP and other initiatives

- The 2018 CDP questionnaire is partly based on TCFD recommendations (a total of 26 questions)

- Especially in the areas of governance, strategy, goals and emissions data (see also Fig. 1)

- The reasons for the alignment with TCFD are for example a wish for increased transparency and the ability to develop a roadmap in order to meet the ‘two-degree target”

- The recommendations contain important scenario techniques (which are now also in the CDP questionnaire)

- In addition, a more detailed analysis of climate-related risks and opportunities is now possible in the context of CDP participation

- Additional information can be found in our blog entry regarding to the new CDP questionnaire 2018

- Regarding the target and scenario description, it is recommended to opt for SBTs.

- In addition, the TCFD matches other frameworks (e.g. GRI, CDSB, …)

Forecast for 2018

- For spring 2018, a web-based knowledge platform is planned (that guarantees an efficient TCFD support for interested companies, available at: tcfdhub.org)

- At the end of the year, field reports as well as presentations of good practice examples are planned to be released

Our services

The DFGE supports your company in terms to consider the TCFD recommendations and in all related measures in order to make your company as ‘climate-fit’ as possible. For example, the calculation of the corporate carbon footprint or the Science Based Targets can be the first strategic steps to identify climate-related risks and opportunities. Participation in the CDP enables the extensive bundling of important data and helps companies understand this topic. Contact us for your Sustainability Intelligence at or + 49 8192 99733-20.

Further information can be found below:

- Article on which a part of this blog post is based

- Implementation recommendations of the TCFD

- Website of the TCFD

- Blog post by the DFGE from the 2nd February 2017