DFGE published this article on 16 June 2021. Since the CSRD is subject to ongoing changes, check here for the latest status and learn everything you need to know.

After the European Parliament’s 2018 call to action to further develop the scope of the existing Non-Financial Reporting Directive (NFRD), the European Commission has now (on 21 April 2021) proposed a revision of the NFRD framework in form of the Corporate Sustainability Reporting Directive (CSRD). Not only will the CSRD build up on the requirements of the NFRD, it aims to be consistent with the existing sustainable finance strategy of the European Union and their legal frameworks, such as the Sustainable Finance Disclosure Regulation (SFDR) and the recently announced EU-Taxonomy Regulation. The revision will furthermore align with the ambitious transformation goals of the European Green Deal. to strengthen the Union’s market economy with focus on sustainable development and also consider the recovery from the Covid-19 pandemic.

What is the purpose of the CSRD and why an update of the NFRD?

In particular, the CSRD will introduce a detailed set of a standard reporting requirement to establish a consistent, comparable and reliable flow of sustainability information for the involved stake- and shareholders of corporations in the EU. Besides that, the EU-Commission described other main drivers of the NFRD Update:

- Insufficiency and lack of information provided by corporations, which is actually needed for holistic decision making, e.g. clear impact of companies on human kind and the planet

- Uncertainty whether the provided information can be trusted

- Too many standards and frameworks for non-financial reporting resulted in overlapping

It aims to be beneficial for both, investors and citizens, regarding the overall quality of coverage of risks and opportunities of sustainability issues due to corporations’ actions.

Who needs to comply according to the extended scope of the proposal?

- All large companies will be held accountable for their impact. Large meaning:

- At least 250 employees (former 500)

- And a revenue of 40 Mio. EUR or a balance sheet total of over 27 Mio. EUR

- Listed companies, on a regulated market in the EU

- All large listed companies

- SMEs with securities listed on regulated markets

- but with simpler standards

- also first effectively applied after a grace period of three years (due to Covid-19 economic difficulties)

- The CSRD will not apply to SMEs with transferable securities listed on SME growth markets or multilateral trading facilities (MTFs)

- Listed micro-enterprises will also be excepted from the proposal

- For non-listed SMEs it will be on a voluntary basis – to help them play a vital role in the future of sustainable development

How about the developing process of the draft standards?

The proposal needs to be transformed to a final legislative text and get approval by the European Council and the EU-Parliament, which is planed until the end of 2022. Afterwards it will be implemented in national law. The official roadmap determines the start of the application for 2023, which means, that the first set of core-standards needs to be adopted by large companies for reports published in 2024. Additional standards for SMEs should follow shortly after.

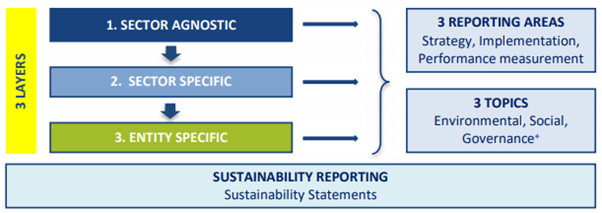

As a contribution to the comprehensive and already existing international standardisation initiatives, the new EU reporting standards will be based on and build up on those, resulting in an architecture of three layers of reporting (sector and entity based), three reporting areas (reflecting the entity’s spirit) and the three well known ESG-criteria.

In addition to the architecture, the conceptual framework will introduce a set of draft sustainability reporting standard requirements which are developed by the European Financial Reporting Advisory Group (EFRAG) and consists of six relevant concepts:

- Alignment to public good

- Quality of information

- Implemented retrospective and forward-looking information

- Levels and boundaries of reporting

- Double materiality (financial and sustainable impact)

- Connectivity

What else is good to know?

For all those new and concrete concepts, an EU-wide audit of the sustainability information will be required to support the need of accurate and reliable reports. However, the CSRD will start with a limited requirement for assurance due to the absence of sustainability assurance standards. According to the proposal, this would open up a new market for independent assurance service providers, resulting in new firms ensuring sustainability information besides existing auditors of financial information.

As a last aspect, digitalization will play a major role to enable broader access and re-use of the data. According to the CSRD, reporting companies will be able to digitally “tag” the information in their sustainability report in a digital categorisation system. Therefore, financial statements and management reports all need to be generated in XHTML format true to the ESEF (European single electronic format) regulation.

Concluding, the CSRD will grant users an improved and European-wide standardised digital access to comparable, relevant and reliable non-financial information. Corporations will be held more accountable, which should lead to more positive social and environmental impacts. The consolidation of different reporting requirements in all the EU-Member States could be interpreted as a burden in the first place. In the long term, however, companies are facing increased expenses in the field of sustainability. Reporting costs could be reduced through clearing up many overlapping standards and frameworks by a single standard reporting solution benefitting all.

Here, the DFGE supports you and your company to take action and to not get left behind. The transition era should be seen as a chance to prepare and take the chance. Take a look at our solutions based on the vision of sustainability intelligence as a whole. If you have further questions, please contact us via or by phone at +49 8192-99733-20.

Sources:

EUR-Lex – 52021PC0189 – EN – EUR-Lex (europa.eu))

Sustainable finance package | EU-Kommission (europa.eu)

Corporate Sustainability Reporting Directive proposal (europa.eu)

EUR-Lex – 52021SC0151 – EN – EUR-Lex (europa.eu)

EUR-Lex – 52021SC0150 – EN – EUR-Lex (europa.eu)

European Lab – Project Task Force on Preparatory Work for the Elaboration of Possible EU Non-financial Reporting Standards – EFRAG