What does ESG stand for?

The abbreviation ESG has become indispensable in today’s world, as companies are increasingly focusing on an ESG strategy and ESG criteria. E stands for Environment, S for Social, and G for Governance. The basic idea is to align the entire company structure and culture as well as its business models according to the ESG values. Large investors and institutional investors, in particular, are increasingly paying attention to the aspects of sustainable investments.

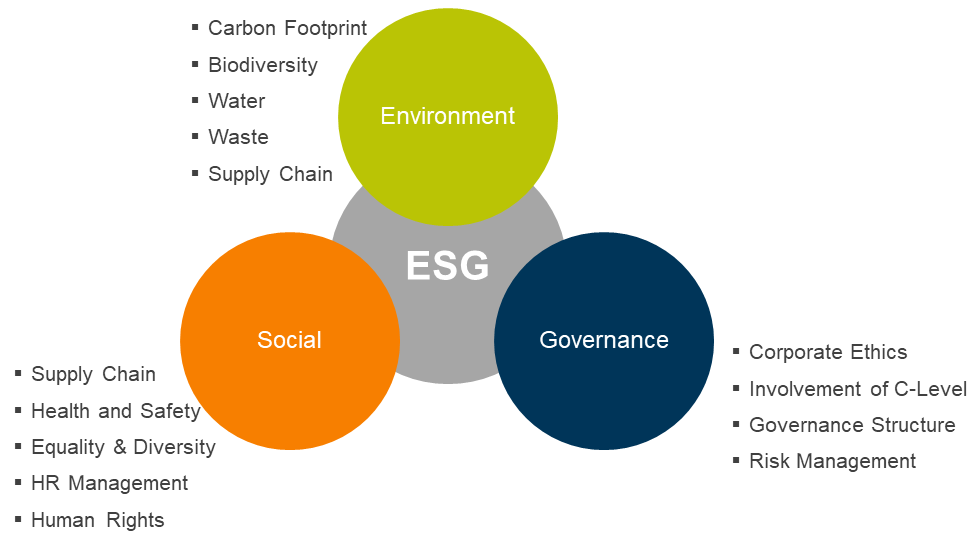

- Environment (E) refers to the impact of the business’ resource usage on the environment such as carbon footprint, wastewater discharge, and biodiversity.

- Social (S) focuses on social regulatory metrics, such as gender pay gap, equality, diversity, health, and also data privacy.

- Governance (G) looks at governance, practices, and policies that ensure adherence to regulatory and legal compliance, e.g. ethics, governance structures, and risk management.

Over the past 20 years, the ESG movement has evolved from a corporate social responsibility initiative launched by the United Nations to a global phenomenon that now represents more than $30 trillion in assets under management. The origins and concept of ESG can be traced to the investment sector, then known as Socially Responsible Investing (SRI) in the 1920s, Responsible Investing (RI) in the 1930s, and Sustainable Investing (SI) in the 1990s. After the publication of the “Principles of Responsible Investing” by the UN in 2006, which states that ESG criteria must be integrated into the investment process, the ESG term has manifested itself. From year to year, investors are increasingly interested in how companies position themselves on environmental and sustainability issues, which is why this topic is gaining in importance. ESG factors focus on a long-term time horizon and serve as an important indicator of the overall health of the company.

The ESG criteria in detail

For each of the three areas „Environment“, „Social“ and „Governance“, indicators can be defined that provide information on how a company acts in the respective areas and fulfills the respective criteria. ESG assesses a company’s ability to create and sustain long-term value in a rapidly changing world, and to manage the risks and opportunities that arise from change.

„Environment“ looks at the impact of a company on its environment. Even though CO2 emissions and energy consumption are currently the main topics of discussion, this term encompasses much more. It also covers effects on biodiversity, resource consumption or use, and many other issues that extend along the entire supply chain. Environmentally relevant issues not only analyze the impact companies have on their environment but also the risks that climate change, for example, can pose to companies. The spectrum ranges from interrupted supply chains due to low water or environmental disasters to events that have to be canceled due to excessively high temperatures.

Just like the other criteria, the „Social“ section is thematically broad. Social criteria are not limited to a company’s relationship with employees, inclusion, and diversity. Rather, it is about all of a company’s relationships with its stakeholders – including, for example, communities in the surrounding area, institutions, interest groups, and the general public. Social criteria are a critical aspect when it comes to a company’s reputation and is becoming increasingly important. This can be seen all too clearly in the EU Social Taxonomy, which was brought into being retrospective as a result of criticism and failure to consider the topic area of social in the EU Taxonomy. Influences from standards that have already existed for a long time can be seen in questions that concern the situation of employees. However, topics that have only gained in importance in recent years, such as diversity and inclusion, are also analyzed. In this context, it is important to point out that this criterion not only considers internal stakeholders but also compliance with social criteria along the supply chains.

Aspects of „Governance“ are also considered in the context of ESG criteria. Here, among other things, the question is addressed of what rules companies set for themselves and how these rules are implemented and publicized within the company. Examples of such rules are the composition of supervisory bodies, measures to prevent corruption, or uniform rules on compensation. Another possibility is C-level involvement, for example, in which management bonuses are linked to sustainability targets. The question of how stakeholder needs are addressed within the company is also explored. The application of ESG criteria here aims to ensure stable corporate governance that combines different perspectives and can thus provide adequate responses to business challenges, opportunities, and risks.

Environment Social Governance and Corporate Social Responsibility – what is the difference?

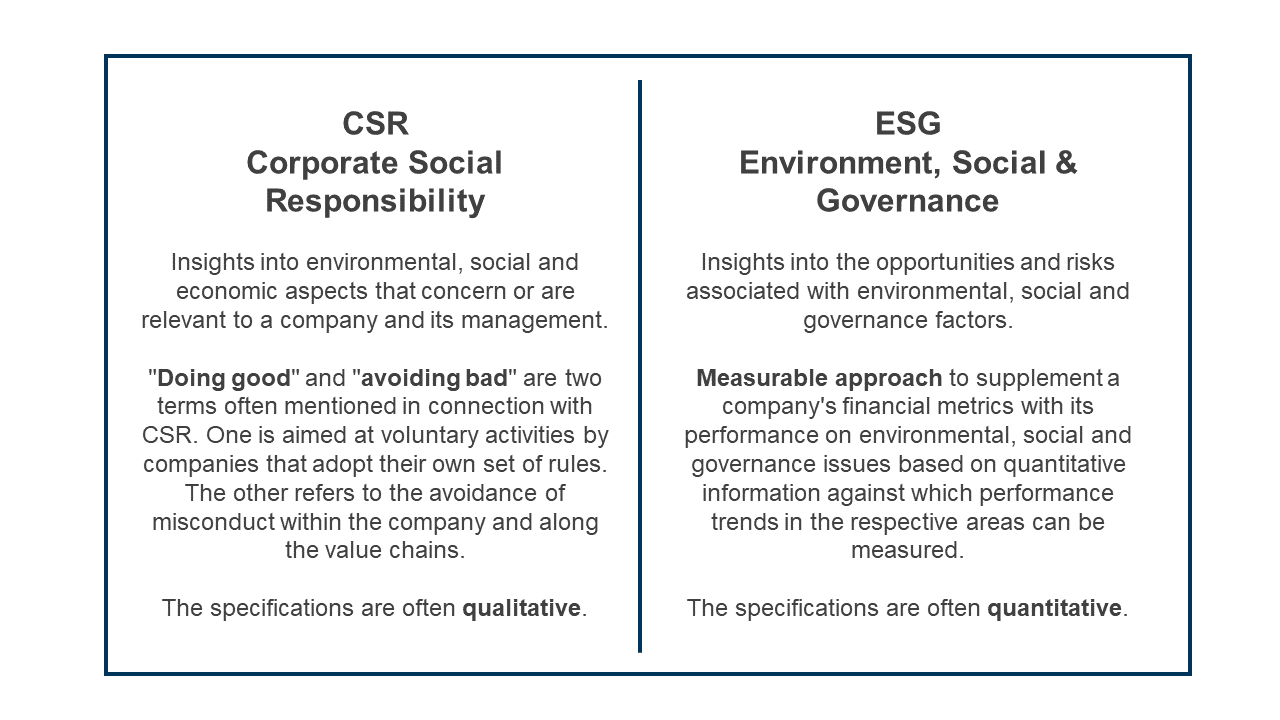

“While CSR aims to make a business accountable, ESG criteria make such business’ efforts measurable.” – Quote from Lexology

The abbreviation „CSR“ stands for the term „Corporate Social Responsibility“ and is understood as the social responsibility of companies against the background of sustainable business. In this context, it is a form of self-regulation that ensures that a company’s actions have a positive impact on the environment, consumers, employees, communities, and the public. Even though the terms ESG and CSR are often used interchangeably, there are clear distinguishing features between the two concepts in addition to their similarities.

In the early 2000s, the term CSR was coined and gained importance. From 2020 onwards, the concept of ESG came to the fore and experienced a significantly higher perception than CSR. Initially in the context of investments, but at the same time also as a corporate tool. Nevertheless, CSR is considered the precursor of ESG criteria and without this concept, the ESG field would not have arisen.

Environment Social Governance Ratings

While companies can use ESG criteria as a strategy and guide to maintain and build their ability to create long-term, sustainable value in a rapidly changing world, they enable transparency for investors. They use ESG ratings to arrive at a holistic assessment of their investments.

An ESG rating measures a company’s exposure to long-term environmental, social, and governance risks. These risks, involving issues such as energy efficiency, employee safety, and C-level involvement, have financial implications. But they are often not highlighted during traditional financial reviews. Investors who use ESG ratings to supplement financial analysis can gain a broader view of a company’s long-term potential.

One of the best-known and most widely used ESG ratings is the MSCI ESG score. The foundation of the MSCI ESG score is a key issues framework that measures risk across 10 categories of environment, social, and governance areas and gives investors transparency on how companies perform in these categories. The MSCI ESG Ratings range from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC).

Why is ESG important for companies?

While Environment Social Governance metrics are relatively new, they have grown in importance because of the rising concerns over climate change, depleting natural resources, economic inequalities, and reporting fraud. There are several good reasons why companies should engage in ESG:

DFGE supports companies in building and adapting their business activities and structure based on an ESG strategy. If you have further questions about ESG, please contact us via or by phone at +49 8192-99733-20.