The Taskforce on Nature-Related Financial Disclosures (TNFD) framework draft is based on the established recommendations by the Taskforce on Climate-Related Financial Disclosures (TCFD). It is an international collaboration that consists of 40 individual members representing financial institutions, businesses and market service providers with over US$20trn in assets. TNFD aims to develop a market-led and science-based framework that enables companies and financial institutions to integrate nature into decision making. While the framework reached beta version v0.3, we give an overview about what exists today and an outlook about what to expect from TNFD.

TNFD Today – Status Quo and framework beta version 0.3

TNFD was established in 2021 and already released the third beta version of its prototype disclosure framework in November 2022. This framework comprises risk and opportunity management that covers not only climate-related disclosures, but also more holistic nature-related disclosures. TNFD claims to respond to a growing need to count nature into financial and business decisions.

The beta release as of November 2022 can be accessed at www.framework.tnfd.global and presents itself in a user-friendly online version in English with translated content provided dynamically by Google. Visitors of the online version are encouraged to create a profile and provide feedback. Alternatively, relevant documents can be downloaded for offline reading.

After emphasizing on why nature matters, the framework gives an executive summary and consists of the following chapters: Introduction, Concepts and Definition, Draft Disclosure Recommendations, Approaches to Risk and Opportunity Assessment, Metrics and Targets, Additional Guidance and Scenario Development.

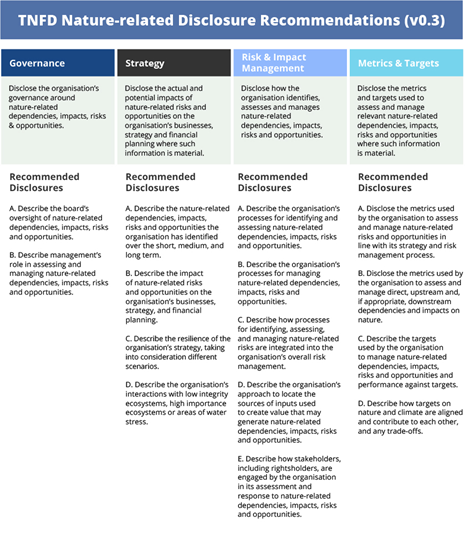

In accordance with received feedback, the TNFD Draft Disclosure Recommendations (see figure below) have a very similar structure, consistency of approach and language as TCFD recommendations. These recommendations are designed to support early market adoption and cover both climate and nature related disclosures.

The TNFD approach to risk and opportunity assessment is based on LEAP and aims to facilitate the incorporation of the assessment into existing risk management systems and reporting methods.

The beta version concludes with a dedicated section that seeks to encourage pilot testing and welcomes participation from a wide range of market participants as well as collaborative pilot testing projects.

What to expect from TNFD

According to TNFD’s website, the next beta framework release is scheduled for March 2023, while the final framework launch is planned for September 2023 with v1.0. During this time period, revisions based on ongoing feedback from market participants and insights from pilot testing will continue until v1.0. The deadline for providing feedback and the conclusion of pilot testing is set for 1st June 2023.

TNFD beta v0.4 will include two Annexes on Disclosure Metrics that will probably be among the most valuable guidance that is needed for getting closer to measuring nature and our impact on nature in a common approach. This guidance will be specific for the already proposed Disclosure Metrics and will include additional details on Assessment Metrics.

In an attempt to enable market participants to start disclosing right after the release of v1.0, TNFD plans to implement a core set of disclosure requirements and an additional set. The latter aims to enhance disclosures, depending on the size and type of the disclosing organisation.

Other top priorities for beta v0.4 are the development of guidance on target-setting in collaboration with the SBTN, additional guidance by sector and guidance on scenarios in collaboration with NGFS and others. Additionally, v0.4 will include draft guidance and illustrative use cases that include example disclosures, developed based on feedback received as part of v0.3.

Conclusion

Considering the status quo of the TNFD framework and its planned upcoming work as well as the fact that over 130 institutions are currently pilot testing the TNFD beta framework, and 46 pilots have already provided feedback, TNFD can be classified as the most promising guidance framework for future nature-related disclosures. The fact that TNFD collaborates with existing networks like TCFD, SBTN, NGFS and builds on established frameworks gives hope that it will allow to effectively broaden existing disclosures from Climate-related to Nature-related Risks and Opportunities. However, it shall be noted that TNFD is still a reporting standard that will allow to report, compare and measure our impact on nature, but does not directly influence how much we are really doing to restore, protect and conserve nature with its fragile habitats and ecosystems.

Sources

[1] Taskforce on Climate-Related Financial Disclosures https://www.fsb-tcfd.org/

[2] LEAP stands for a 4-step Method following the steps Locate, Evaluate, Assess, Prepare

[1] TNFD Website – About https://tnfd.global/about/#who

[2] TNFD Website https://tnfd.global/

[3] Science Based Targets Network https://sciencebasedtargetsnetwork.org

[4] Network for Greening the Financial System https://www.ngfs.net/en

[5] LEAP stands for a 4-step Method following the steps Locate, Evaluate, Assess, Prepare

[6] Taskforce on Climate-Related Financial Disclosures https://www.fsb-tcfd.org/